Realtimecampaign.com Asks the Question: What Is Shareholder Activism and How Does It Work?

Shareholder activism can be a good thing, but it can also bring about problems for corporations. Corporations need to be aware of what shareholder activism is and how it works so they can protect their organizations. Keep reading to discover here.

What Is Shareholder Activism?

When people become shareholders in a company, they often feel they have a vested interest in how the corporation operates, especially if the investor holds significant stock, according to realtimecampaign.com. Shareholders who want to seek change within a corporation may pursue different tactics to bring about their desired wishes.

Shareholder activism has been a problem for corporations since the 1980s. Back then, these activists were often referred to as corporate raiders. Often, the activities of shareholder activists resulted in breaking up corporations for various reasons.

What Are the Goals of Shareholder Activism?

Those who are unfamiliar with these activists may wonder why someone would want to get involved in breaking up a company or causing it to change. Company owners must hedge themselves against disruptions. Shareholder activism at the AGM practical steps for public companies to mitigate disruption.

The primary goal of shareholder activists is to use their voting power to bring about change within a corporation. The goals of today’s activists are broad and encompassing. Often, these activities fall under the heading of capital allocation strategies. This means the shareholder activists are looking for the return of large amounts of cash back to shareholders via stock buyback or dividends.

Reasons Shareholder Activists Are Attracted to Companies

Although shareholder activists each have their own agenda, companies that tend to attract these activists often have a few things in common. The following are some of the reasons a company might become attractive to shareholder activists. Reach out to Sidley Austin for help.

-

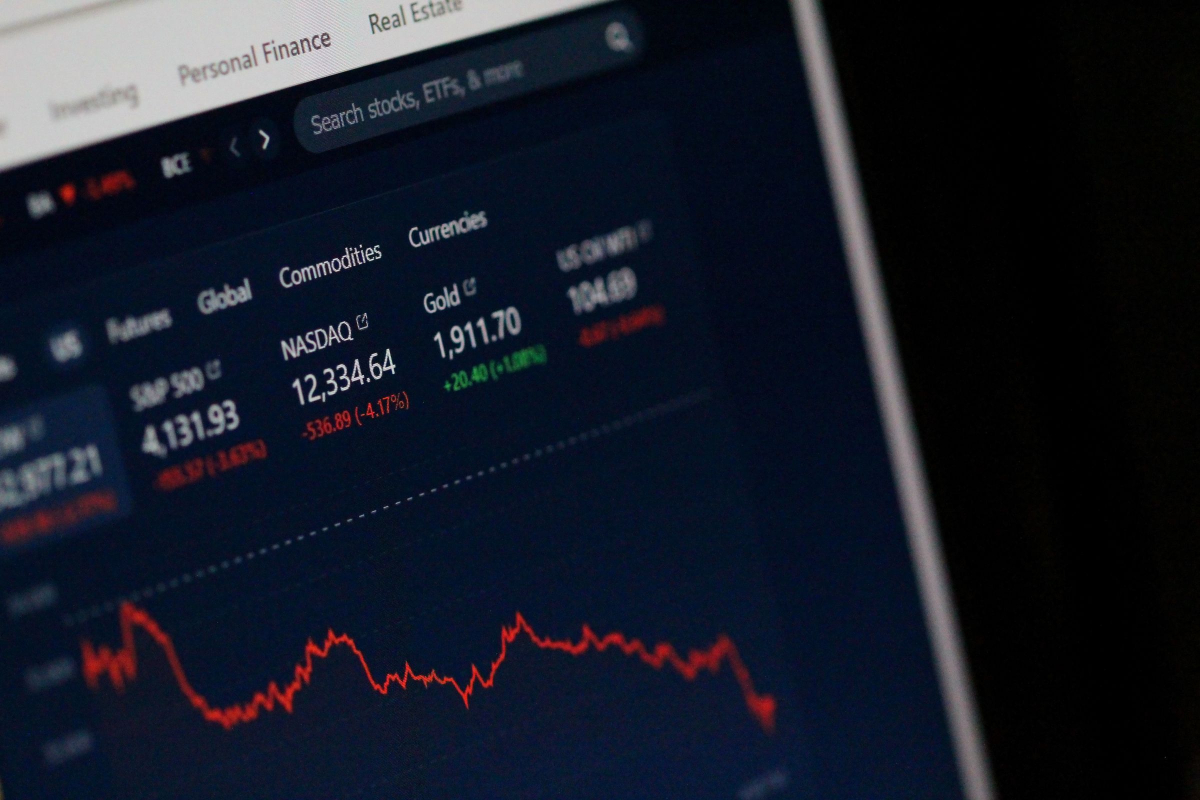

The company is performing poorly in the stock market.

-

A company may be experiencing weak earnings compared to its competition.

-

The company is facing governance missteps.

-

Companies may lack attention to essential ESG matters.

Any of the above can trigger shareholder activism in corporations. It is essential companies work to keep their operations running smoothly and successfully. While shareholder activists cannot always be avoided, there are ways corporations can put up a hedge of protection against activism.

Tips for Responding to a Shareholder Activist

Corporations must prepare for the possibility of shareholder activists. Directors must take on key roles in preparation or corporations could experience disruptions to their day-to-day operations. The following offers some tips that should help corporations respond to shareholder activists appropriately.

-

Understand the triggers and try to alleviate the problems.

-

Respond to all investor inquiries promptly.

-

Develop a dialogue with unhappy investors.

-

Be respectful and not defensive.

-

Be very careful in making any changes to governance.

The way directors respond to shareholder activism is critical. If a company does not respond in the right way, it can make matters worse. The best way to avoid shareholder activism is to conduct company business fairly and effectively. Shareholder activists typically only get involved when there are sinking corporations that are neglecting their responsibilities in the corporate world.

Media Contact

Company Name: Realtimecampaign.com

Contact Person: Media Relations

Email: Send Email

Phone: 407-875-1833

Country: United States

Website: Realtimecampaign.com